Retainage

Installation & Configuration

A number of standard NetSuite modules are required in order to successfully install FullClarity Retainage. These NetSuite settings are available by selecting "Setup", "Company", "Enable Features". Any missing settings will be automatically flagged during the installation process.

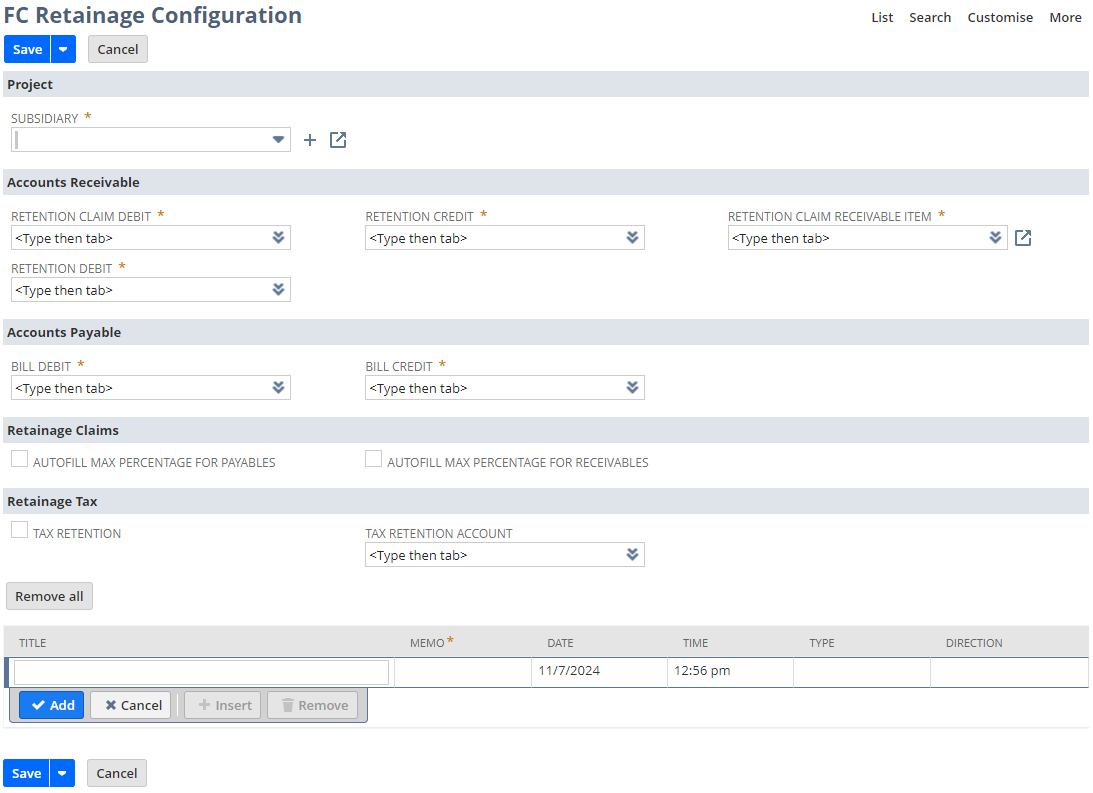

Configuration Records

This SuiteApp is requires a separate configuration record for each subsidiary. This allows us to ensure the GL entries that are raised in each subsidiary are entered into the correct accounts for that subsidiary.

| Field | Description |

|---|---|

| Subsidiary | Select the subsidiary that the configuration record relates to. If there is only 1 subsidiary, just select "Parent". |

| Accounts Receivable | |

| Retention Debit | Typically a balance sheet account sitting in either the Receivables or Other Assets section. After creating a sales invoice that includes retentions, the asset balance is posted here. |

| Retention Credit | Typically the main Accounts Receivable account. After creating a sales invoice that includes retentions, the reduction in Accounts Receivable is posted here. |

| Retention Claim Debit | Typically the main Accounts Receivable account. After requesting for the retention to be paid, this is the receivables account showing the tracking the outstanding balance. |

| Retention Claim Receivable Item | This is an item created in the master item list. This item would typically be called "Receivable Retention Request", and is used as the primary item on the retention invoice sent to the customer. See Retention Claim Receivable Item below for more information. |

| Accounts Payable | |

| Bill Debit | Typically the main Accounts Payable account. The balance in this account is debited when the retention is raised upon the creation of an invoice, and is credited when we receive a retention invoice from our supplier. |

| Bill Credit | Typically a balance sheet account sitting in Other Current Liabilities. This account holds the retention payable on the balance sheet. |

| Retainage Claims | |

| Autofill Max Percentage for Payables | |

| Autofill Max Percentage for Receivables | |

| Retainage Tax | |

| Tax Retention | Check this field to include tax calculations in retentions journals. |

| Tax Retention Account | The GL account used to post the tax retention - typically the same account used to post GST or VAT. |

Retention Claim Receivable Item

As mentioned above, This item would typically be called "Receivable Retention Request", and is used as the primary item on the retention invoice sent to the customer. The item dictates the accounting treatment of the retention invoice, which would typically be set to the balance sheet asset account that holds retention receivable balances.

Retention on Payables

Retention on Payables is triggered on vendor bills in NetSuite. When a payable retention is created, it has the effect of moving the retained amount from Accounts Payable to another balance sheet account, and sets the bill as paid to the extent of the retained amount. For example, for a bill of $5,000 with a 10% retention, the bill will appear in Accounts Payable with an amount owing of $4,500 and in Retentions Payable with an amount of $500.

Where the Tax Retention is configured, the retention calculation factors in the VAT or GST payable on the invoice, and reduces the tax balance associated with the bill.

Vendor Default Retention Rates

A default retention percentage can be set on the vendor record. When this is set, every vendor bill from that vendor will default to having a retention set. This can be changed by editing the vendor bill in the event that a specific invoice has a different retention percentage, or no retention at all.

To set the default retention percentage on the vendor, locate the "Retainage %" field and populate it with a percentage amount. This field is tpyically on the Retainage sub-tab on the vendor record, but may have been moved on your vendor form template.